April 18, 2025

Only one split to consider for our April rebalance, and it's a doozy. O'Reilly Automotive, Inc. (ORLY) has announced a 15 to 1 split to be distributed in June. Founded in 1957, O'Reilly operates over 6,300 stores across the US, Canada, Mexico, and Puerto Rico. If you have ever changed your own oil or replaced your wiper blades, you've probably shopped at an O'Reilly store. This is a great example of the kind of company I wrote about in last month's newsletter - a business that sells stuff people actually need. Started by the O'Reilly family with one store in Springfield, Missouri, the company has grown, mostly by numerous acquisitions, to be the dominant auto parts retailer across all of North America with a market cap just shy of $80B.

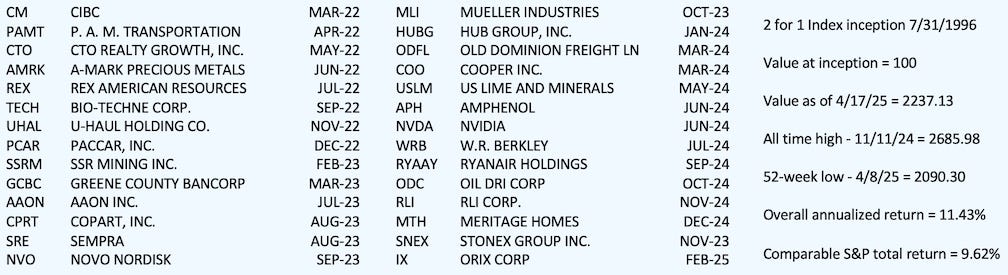

ORLY is primarily a growth story. Sales; +10.5%/year over the last five years. Earnings; +17.8%/year over the last five years. Profit margin; 14.3%. The company has no debt and trades with a volatility (Beta) only about 65% that of the market. The only negative, from my perspective, is the lack of a dividend, but I'm still going to go with ORLY for the April addition to the 2 for 1 Index. Cars are not as easy to work on as they used to be but there are still plenty on people who like to fiddle with their cars, and there may be more older cars on the road as new car prices continue to escalate. I'm counting on ORLY to be a safe bet for the 2 for 1 Index.

CIBC (CM) is the stock that has come to the top of the Index ladder and would normally be up for deletion for this month. However, P.A.M. Transportation (PAMT) is going to be deleted instead. The PAMT Board of Directors is soliciting 435,000 shares to be purchased via a "Dutch Auction" for a price of between $14.50 and $17.00. The shares must be tendered by the deadline of May 1. The Index, of course, does not actually own any shares of PAMT but, by deleting the shares from the Index before the auction takes place, the Index will realize probably close to the best value we will see for this company for the near future.

For any readers who have PAMT in their portfolio, I have no specific advice, but I will mention that I have tendered, for $14.50, all the shares I currently own in my IRA account. If my tender offer is not accepted I will probably sell at market value early in May.

Just a word about the President's messing around with our country's tariff policy. No matter how this all shakes out in the end, Trump's policy will be whatever is best for him, politically and financially, not what is best for the country. Some companies, industries, and sectors will probably benefit, and others will surely be hurt. Keeping the Index fully invested in a well-diversified list of well-run companies is our best hope of weathering any storms that may be just over the horizon.

In summary, for April, ORLY will be added to the Index and PAMT will be deleted. The 28 stocks in the Index will be rebalanced to equally weighted positions at market close on Monday 4/21/25.

Neil Macneale

© Copyright 2025 - Neil Macneale III

PDF version available at 2-for-1.com/archive